sVault Finance

sVault , Enjoy the unlimited power of compound interest, by holding and owning SCORE tokens

What are Agricultural Products?

At its core, yield farming is a cycle that allows cryptocurrency holders to secure their property, which in turn compensates them. Strictly speaking, this is a cycle that allows you to earn a fixed or variable premium by placing your crypto on the DeFi market.

Basically, yield farming includes raising digitalized money through methods for the Ethereum network. Exactly when credit is made by the bank method using fiat money, the entire loan is handled at a premium. With yield farming, the thinking is an exception: cryptocurrencies that will somehow sit on an exchange or in a wallet are developed in a way for DeFi gigs or ensured in a smart arrangement, in Ethereum terms for returns.

About sVault Finance

sVault Finance is a DeFi Stake and Yield Farming Platform. The sCORE token is a decentralized checking platform that generates revenue reserved for its testers by circling grants to customers according to the proportion of the tokens stamped and the maintenance period of the tokens at the stamping stage. In addition, to produce farming methods with smart agreement methods, SCORE provides security organizations to natural users as a DeFi entry and shows everything in Blockchain to users for transparency purposes. sCORE can easily be planned with DEX or multiple stages for agricultural infrastructure yields and commission limits. sCORE tokens can be used for stamping, farming, fee rewards, project voting forms and organization in the sVault Finance stage.

farming: 1% fee from each trade is spread among all holders. The rates that holders earn are directly compared to the proportion of tokens held in wallets in compensation hours. Thus, each holder gets a ton of fees. Electronic portion There is no central social event allocated by scatter. Wages from stock trading, unstake and agriculture spread to the stakers and a small part of them was burned. Similarly, it intends to generate the modest income it provides its testers by further reducing stock.

Procedure

- Limited RISK Interest Account

hope to give you amazing results returns as fast and simple as normally possible. That's why our novelty is one of the most natural and accessible in our portfolio.

- Mechanical income

You are guaranteed a fixed rate of interest in your assets. Watch your holding reserves grow daily, pull them out whenever you need. Money works for you all day long, consistently, even when you're resting.

- Withdraw ANYTIME

Your resources are never knocked over as is often the case with typical bank speculation accounts. You are allowed to withdraw resources at any time with one snap.

- HOLD SCORE

To make a profit, HOLD or use trading options on exchanges where SCORE is available! Like advances in DeFi to smoothen your payments.

In sVault Finance, progress and profits will be maintained only for express assets and sCORE token holders will save profits for projecting various forms of token voting which must be maintained in order to be credited and jump to sVault Finance. Each vote is charged to the sCORE Tokens.

MINING LIQUIDITY INCENTIVES

At the score, customers can offer liquidity to farm stocks and batches. Customers do not need to confirm SCORE in the pool. Customers providing liquidity will be rewarded with mining liquidity impulses.

- These rewards are awarded as sCORE Tokens.

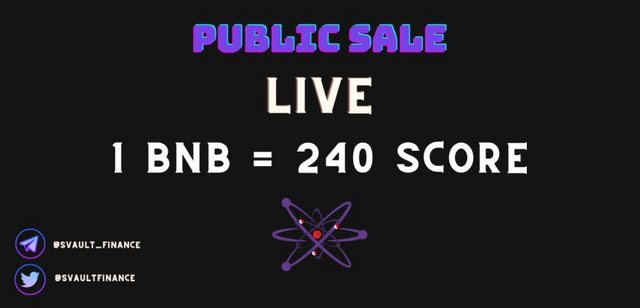

- TOKENOMY

- Token Name: sVault. Finance

- Token Type: BEP20 - Binance Smart Chain

- Ticker: Decimal score: 18

- Total Supply: 10,000,000 scoreCORE

Distribution Ecosystem: 30% (Stake 15%, Farm 15% will be discontinued until November 2022)

Team: 3% (Fired for a very long term, and 5% will be shipped monthly.)

Marketing: 7% (Bounty Program 7% , will be

extended to April 2021) Liquidity: 15% and bscswap at the start of liquidity will be part of the total sales revenue. BScswap's underlying liquidity will remain rushed for the long term.

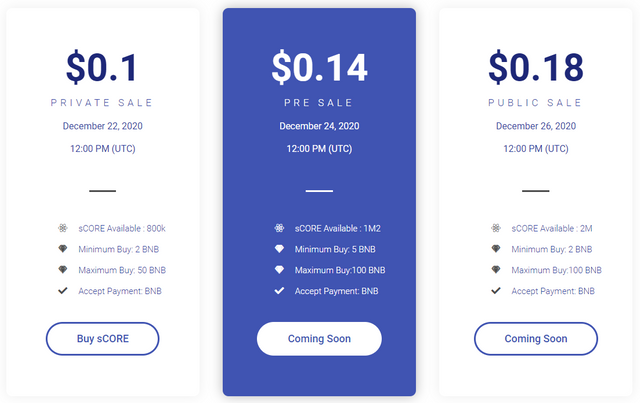

Pre-sale: shop the highest 40% will be awarded. No lock

SVAULT FINANCE

At the scoring stage, the center maker or accompanying square generator is chosen by the method to a certain formula in which the center producer has to bet their score tokens, so we use it sporadically to predict convenience. Create later using a formula to find the hash that is least significant with respect to stake size.

So we're trying to achieve sensitivity instead of POW, where the rich diggers get all the money. Because the stakes are public, each center can predict with reasonable precision that the note that accompanies it will get a chance to deliver the square.

Store rewards will be provided by the sVault dAPP, not by the customer making the trade. sVault uses Proof-of-Stake as the regulatory framework. In Proof-of-Stake, to become a central validator, they need to stake their sCORE Tokens to be selected as a co-central point validator. Consequently, the SCORE Tokens will be awarded to organizations of people who bet on their tokens.

Coordinated sVault Finance Platforms can be linked to wallets, and financiers can without a doubt stake their tokens on the app. In the early stages of the effort eg in the sVault Finance stage, testers can transfer their tokens to their wallet or one more stage at any time with no token locking time.

SVAULT GOVERNANCE

In sVault Finance, progress and gains will be maintained for express assets only and score token holders will retain profits to project the voting form of various tokens which must be maintained for crediting and jumping to sVault Finance. Each vote is charged in sCORE Tokens.

LIQUIDITY INCENTIVE MINING

On the score, customers can offer liquidity to betting pools and farms. Customers should not be sure about the score in the pool. Customers providing liquidity will get liquidity impulsive mining rewards.

Token Name: sVault . Finance

Token Type: BEP20 – Binance Smart Chain

Ticker: score

Decimals: 18

Total Supply: 10,000,000 scoreCORE

Distributions

- Ecosystem: 30% (Staking 15%, Farming 15% will expire until November 2022)

Team: 3% (fired for a very long time frame, and 5% will be delivered monthly.)

Marketing: 7% (Bounty Program 7%, will be rushed to April 2021)

Liquidity: 15% and bscswap at the start of the liquidity will be part of the total collected in the presale. Bscswap's underlying liquidity will remain a rush for the long term.

Presale: 40% of the highest store will be given. Unlocked

Conclusion

sVault is a DeFi venture. The DeFi area is crowned as a new uniqueness that renews the digital money industry. DeFi is a monetary instrument as a blockchain-based administration and application. sVault Finance is a DeFi Stake and Yield Farming Platform. sCORE token is a decentralized staking platform that generates latent income for its speculators by rewarding clients as indicated by marked token sizes and token maintenance seasons at staking stages. sCORE can be combined easily with DEX or other stages for yield farming infrastructure and commission returns. sCORE tokens can be used for staking, farming, charging rewards, voting, and administration in the sVault Finance stage. Each holder of course gets most of the fee. Installations are robotized. There is no focus pool allocated with dispersion. As for today's DeFi world, sVault is getting closer in a very natural and thoroughly organized way.

For more information about this project, see the link below:

Website: https://svault.finance/

Facebook: https://www.facebook.com/sVaultFinance

Twitter: https://twitter.com/sVaultFinance

Telegram: https://t.me/sVault_Finance

Linkedin: https:/ /www.linkedin.com/company/svaultfinance

GitHub: https://github.com/sVault-Finance

Komentar

Posting Komentar